Cato Network secured $238 M and is now valued at $3B

Cato Networks, a startup based in Tel Aviv, recently announced that it has secured $238 million in equity investment. This funding values the company at over $3 billion. LightSpeed Venture Partners led the investment round. It included participation from Adams Street Partners, Softbank Vision Fund 2, Sixty Degree Capital, and Singtel Innov8, bringing Cato’s total funds raised to $770 million.

In a recent email interview with TechCrunch, Shlomo Kramer – the CEO and founder of Cato – explained that the company plans to use its latest funding to expand its organization in three key areas. These include reaching a wider audience with their vision and customer success, expanding their partner ecosystem offerings, and growing their engineering and product team. Kramer, a computer scientist and mathematician, founded Cato in 2015 to create a platform that simplifies network security while minimizing legacy approaches’ complexity, costs, and risks.

As stated by Kramer, the constantly evolving threat landscape, the complexity of securing remote and hybrid work environments, and the need for scalable and agile solutions pose significant challenges to the cybersecurity and networking industry. Simply adding another point solution to meet each problem is not the solution. It only increases the complexities and costs of IT. A single platform is required to address all of these challenges while reusing existing spend.

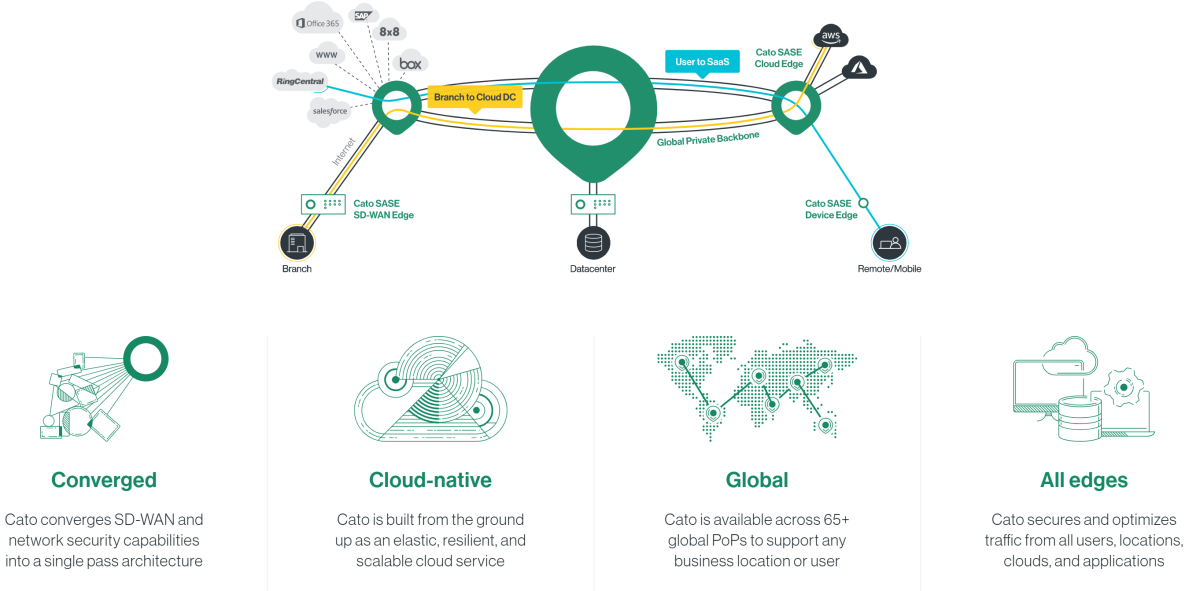

Cato offers a cloud-based mesh that enables businesses to connect to network resources regardless of location. The company has points of presence worldwide that provide access points to its and other networks. As previously mentioned, these access points offer Cato’s networking and security resources.

Cato has a comprehensive database that stores all the metadata of network flows for every device that is connected to its cloud. In addition to that, it uses security information to enrich the database. This database aims to help Cato create robust AI models for security and management tasks such as data loss prevention and malicious file detection over the network.

Cato relies on purpose-built AI to autonomously process over 250 threat intelligence feeds, filter out irrelevant indicators of compromise, and publish updated blacklists to its entire cloud every four hours without human intervention. The company also uses deep learning algorithms to prevent threats, identifying malicious domains commonly used in phishing and ransomware attacks.

Cato’s network is a software-defined vast area network that utilizes software to manage the connectivity, services, and management between connected devices and cloud resources. Additionally, it’s classified as a SASE, which means that the network and security controls are provided directly to the source of connection rather than through a data center.

In the post-pandemic era, SASEs and SD-WANs have become popular due to the widespread distribution of workers and apps. Companies are also grappling with an increasing number of devices on their networks. According to a recent survey from Omdia, SD-WAN revenue is projected to reach $6.4 billion by 2025, a $600 million increase from the previous forecast. Furthermore, the Dell’Oro Group discovered that SASE growth increased by over 30% in Q2 2022 compared to Q1 alone.

Cato has been able to thrive despite facing stiff competition from established players like Palo Alto Networks. The company now boasts a network of around 670,000 remote users spread across its customer base of over 1,900 enterprises and achieved annual recurring revenue of over $100 million last year.

According to Kramer, Cato’s cloud-native service that merges network and network security eliminates the need for IT teams to manage operational complexities, risks, costs, and manual effort. This allows enterprises to concentrate on business objectives rather than maintaining their network infrastructure. Cato sets itself apart by offering a global, cloud-native network with integrated enterprise security capabilities, removing the need for multiple-point solutions and simplifying IT teams’ work.

Cato’s ultimate goal is to go public in the next year, as Kramer has hinted in past interviews. However, according to Kramer, the latest funding round will not affect these plans.

Cato intends to use the new funding to expand its product offerings and global reach. By the end of the year, the company plans to increase its headcount from 800 employees to more than 900.

Kramer stated, “The pandemic has accelerated the need for secure and scalable remote work solutions, which aligns with our strengths. We have adapted to the changing landscape and experienced growth. Our financial position and growth strategy enable us to weather any potential headwinds, including any slowdown in the broader tech industry. We remain committed to maintaining a sustainable financial model that supports our growth objectives.”

Overall, Cato is well-positioned to continue its growth trajectory while maintaining a financially sustainable model that supports its expansion plans.